The home you want. the tool to get you there.

With a Purchase Money Second Mortgage*, you get to skip right past Private Mortgage Insurance—and straight into the home you want!

(It’s also a great way to avoid taking out a “jumbo loan” for a mortgage in the $600K range or above.)

Here’s how a Purchase Money Second Mortgage works:

Typically, Private Mortgage Insurance (PMI) comes into play when you put less than 20% down toward a home purchase. In exchange for accepting the risk of taking a smaller down payment, your lender will add PMI to your mortgage, which increases your mortgage payment.

With a Purchase Money Second Mortgage, there’s no PMI to worry about. Plus, all payments you make toward your Purchase Money Second mortgage loan will go toward the principal and interest on that loan! (It may even reduce your tax liability; ask your tax advisor for details.)

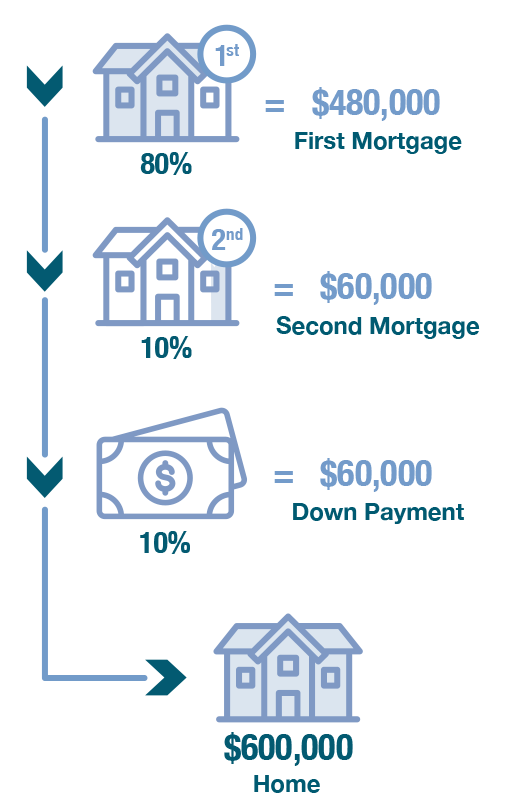

Financing your new home is as easy as First, Second, Cash

![]() First is your first mortgage. This first mortgage covers 80% of the purchase price of the home you want.

First is your first mortgage. This first mortgage covers 80% of the purchase price of the home you want.

![]() Second is your second mortgage, or Purchase Money Second Mortgage. This covers an additional 10% (or, in some cases, 15%) of the purchase price of the home.

Second is your second mortgage, or Purchase Money Second Mortgage. This covers an additional 10% (or, in some cases, 15%) of the purchase price of the home.

![]() Cash is your 10% (or as low as 5%, in some instances) down payment, which covers the remaining balance of your home loan.

Cash is your 10% (or as low as 5%, in some instances) down payment, which covers the remaining balance of your home loan.

*Loans are subject to creditworthiness and other underwriting criteria. Not all applicants will qualify. Certain restrictions apply. Rates, program terms, and conditions subject to change without notice. Membership required. Closing costs and fees may apply.Here’s an example of a Purchase Money Second Mortgage in action:

Let’s say the home you want is $600,000. You’ll take out your first mortgage for 80% of the total cost, which is $480,000. Then, you’ll take out your Purchase Money Second Mortgage to cover the next 10% of the cost, which is $60,000. Together, your first and second loans add up to 90% of the home’s total cost; now, you come in with your 10% cash down payment of $60,000 to make up the difference, and you’re fully financed for your new home… while avoiding PMI!

Get what you need to get into the home you want

Our local mortgage team can’t wait to answer your questions about how a Purchase Money Second Mortgage can help you get into your next home!